Navigating The Financials of Your Product

Form your own opinion of the financial health of your product

Your customers say your product is priced too high and your finance leader says your product isn't priced high enough. Who is right? It doesn't matter who is right. What matters is your opinion!

Product pricing feedback is one aspect of your product's financial status. However, there is more to evaluating financial status beyond pricing. To reach an informed opinion on your product pricing and financial status, here are the steps to take:

Learn the basic ingredients product financials

Collaborate with your financial team

Compare your financials to similar products

Let's dig into forming your own opinion of your product's financials.

The Basic Ingredients of Financial Performance

When thinking about product financials, the product team often turns to pricing. Pricing defined:

Fixing the value that you will receive in exchange for your product and service.

Pricing is just a number. How your product team gets to that number is complex and has many considerations.

There is more to financial performance than high or low prices.

Some of the key ingredients of financial performance are:

Units of measure: What is the customer paying for each unit of sale

Cost of each unit: How much it costs your organization to deliver that unit to the customer

Revenue: The amount of money brought in by operations over a set amount of time

Profit: The revenue minus the cost

Margin: The ratio of profit to revenue

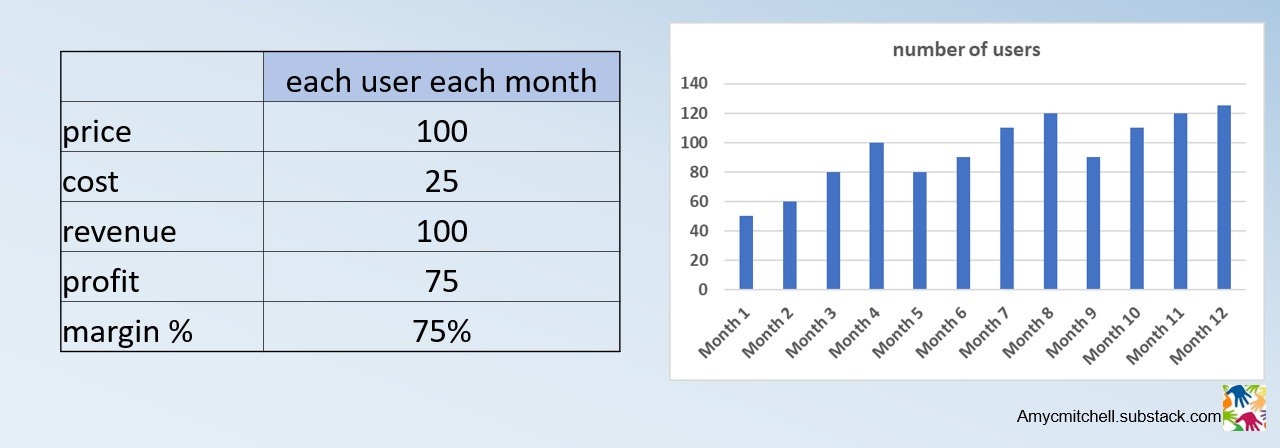

The following worksheets show how a product manager on an example SaaS product can evaluate their essential financial ingredients. In this example, each user of the SaaS product has a monthly fixed price with fixed costs. New users come and go each month which drives the monthly revenue.

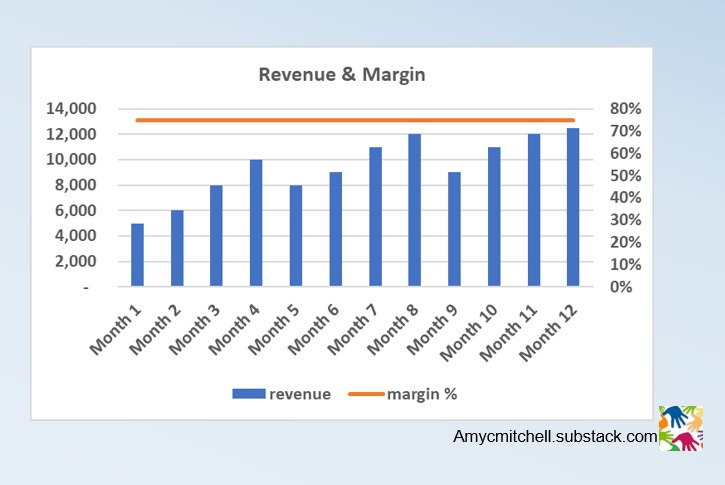

The example SaaS product has a fixed price and costs while the number of users varies each month. The monthly revenue varies due to the number of users. The cost per user is fixed and the margin is fixed. The product revenue and margin each month are below.

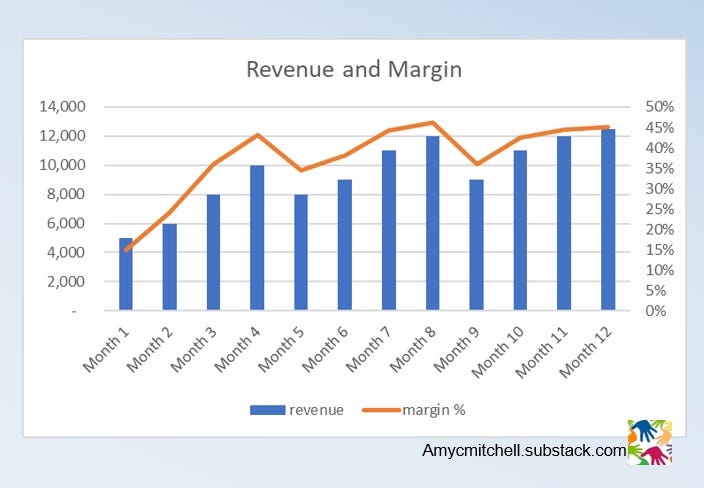

How do you account for your engineering and support teams in the product's margin? The salaries and benefits of your product team come into play in the product's margin calculations. In this example case, both teams are growing monthly. Here are the combined costs and revenue.

After adding in the engineering and support costs, what is the margin of the product? This is shown below with the monthly margin graphed on the right and the monthly revenue graphed on the left.

With the variable costs of the engineering and support teams plus the product costs, the margin varies from month to month as the users grow and shrink. In this case, the margin goes from 15% to 45% over the year with the total margin for the year at 40%

Now that you have the basic product financial model, is this good or bad? It depends.

How Finance Looks at Your Product

Your corporate finance team watches many factors on the financial health of your product.

You can get many product insights by collaborating with your financial controller. In addition to forecasting revenue, costs, and margins, your controller is responsible for cash flow, return on investment, and more.

For a start-up with a single product, the financial controller is busy with managing investments and reporting on the payback of investments. In larger multi-product organizations, the financial controller is managing financials at the corporate level. In both cases, the finance team has minimal time allocated to tracking financials at an individual product level.

This means you have limited roll-ups of your product's financial data. You do get quarterly data on revenue and costs for your organization and sales data on your product.

The summary is you need to construct your own revenue, cost, and margin model for your product. Your finance team is focused on the bigger picture.

By collaborating with your finance team, you can get crucial insight into the financial health and trends of your product. In the above example, the financial team provides this feedback:

Reduce the churn of the users from month to month

Keep user growth ahead of engineering and support growth

Look for ways to grow revenue without additional cost

You probably don't like the feedback from your financial team because you are actively working on improving your product's outlook. This feedback is very important in prioritizing your product work to accelerate financial health.

Look Outside Your Organization

Now that you have looked at your own product's finances, you can look outside your organization at similar products. Publicly traded companies that have similar characteristics can give you good financial information. What you can pull out of public financial reports are:

Quarterly and annual revenue

Costs

Margins

A quick search on the internet shows the corporate net income for public SaaS companies. Net income gives a rough approximation of margin %. A few net income examples are:

Zoom 16%

Adobe 33%

Salesforce 15%

With this information, you have something to compare to your own product margin.

Conclusion - Understand and Track Your Product Financials

Creating a product manager's view of your financials has these benefits:

A point of view for collaboration with your finance team

Options to improve financial health with new initiatives

Segmentation of profitable and unprofitable customers

You can get more benefits by tracking every month. For example:

Prioritizing investments for improvements in margin

Forecasting marketing and sales plays on revenue growth

Evaluating pricing and discounting for trade-offs in profitability

The best part of all is forming your own opinion of your product's financial health!

Link of the Week

Deciding to Build a Feature to Close a Sale Collaborating with sales on customer feature requests and a decision tree on handling feature requests from customers.

by Ben Yoskovitz has feedback from leading product managers on handling this situation.

In a B2B SaaS product I would not segment dev resources beyond your organizational boundaries for business model purposes. I would evaluate the custom request independently and continue modeling the product as a whole. If you decide to do the custom feature you have a great item to discuss with your finance team. The good thing about this rough financial model is you have a basis to form your recommendation for product decisions by collaborating with experts in your organization.

How do you attribute revenue from product enhancements, if at all?

Let’s say my product generates £1m/year. It’s a SaaS product with a monthly license, so simple MRR/ARR. The cost of running the product itself is maintenance of dev team, which I assume you take as a sunk cost (aka you pay for them regardless of what they do).

Now let’s say a customer asks us to build a feature for which, once implemented, they would pay us an extra 1m/year.

This extra 1m/year sounds nice but it distracts our dev team from maintenance. Choices are to be made.

Do you allocate the extra revenue and match it against cost differently because it’s a “custom feature”? Do you allocate a certain amount of dev resources per year on ‘custom’ work and therefore it’s not really a factor?

Any insights would be good to hear!